Life is unpredictable and uncertain. Dealing with unpleasant situations can only be achieved through proactive measures. Therefore, ‘insurance’ was developed to mitigate risk and provide protection. It is an essential tool to manage life’s troubles. Today, you can protect your loved ones and the things you cherish with various insurance policies. The purpose of life insurance is to pay a certain sum of money to the insured’s family in the event of his death.

The Insurance Regulatory and Development Authority of India (IRDAI), which regulates India’s insurance and reinsurance industries, has approved and recognized 24 life insurance companies in the country.

Suppose you are interested in finding the best term insurance plan according to your unique needs. In that case, we recommend clicking this button, filling in a few insurance-related fields, and letting our system recommend a suitable insurance plan.

To protect one’s family, insurance is an essential purchase. Investing in insurance before planning your financial future is even recommended by financial advisers. The benefits of insurance are numerous. Among them are the following:

In India, the government owns the Life Insurance Corporation of India, also known as LIC. 1956 was when LIC, one of India’s top 10 insurance companies, was founded. The LIC has 2048 branches, 113 divisional offices, eight zonal offices and 1408 satellite offices in every corner of the country. Today, LIC manages a total of USD 450 billion (INR 3,111,847 crores).

LIC, the leading insurance company, insures over 29 crores of policyholders. Through its excellent customer services on the digital platform and branches, and other tie-ups, LIC is a trusted insurance brand that offers great convenience to customers. There are several life insurance products available through LIC that can satisfy the needs of different market segments. LIC has consistently been recognized and awarded for all its milestones. Among the awards LIC has received are:

Max Life Insurance Company, India’s largest non-bank private sector insurer, was founded in 2000. Founded by Mitsui Sumitomo Insurance Company and Indian Max India Ltd, Max Life Insurance Company operates as a joint venture. In India, Max life company has assets under management of 90,407 crores and a customer base of over 32 lakhs. Max life insurance company is among the fastest-growing insurance companies in the country.

The Max Life Insurance Company provides high-quality customer service through its online presence, a wide range of products, and multiple distribution channels. The company has consistently received awards and recognitions. Claims Service Leader and Excellence in Claims Service were given to Max Life by the CMO Asia Awards for its high claim settlement ratio. They offer a wide range of products in the market that you can choose from.

HDFC Life Insurance Company is a joint venture between HDFC Ltd, one of India’s top lending institutions and Standard Life Aberdeen, one of the world’s largest investment firms. The HDFC Life Group was founded in 2000. It offers multiple insurance and investment products to a broad range of customers. In addition to 390 branches and additional distribution touchpoints, HDFC Life partners with 22 bancassurance companies across India.

Customers have easy access to services due to a robust digital platform. In recognition of HDFC Life’s contribution to the Indian insurance industry, the company has received many accolades and awards. Here are a few examples:

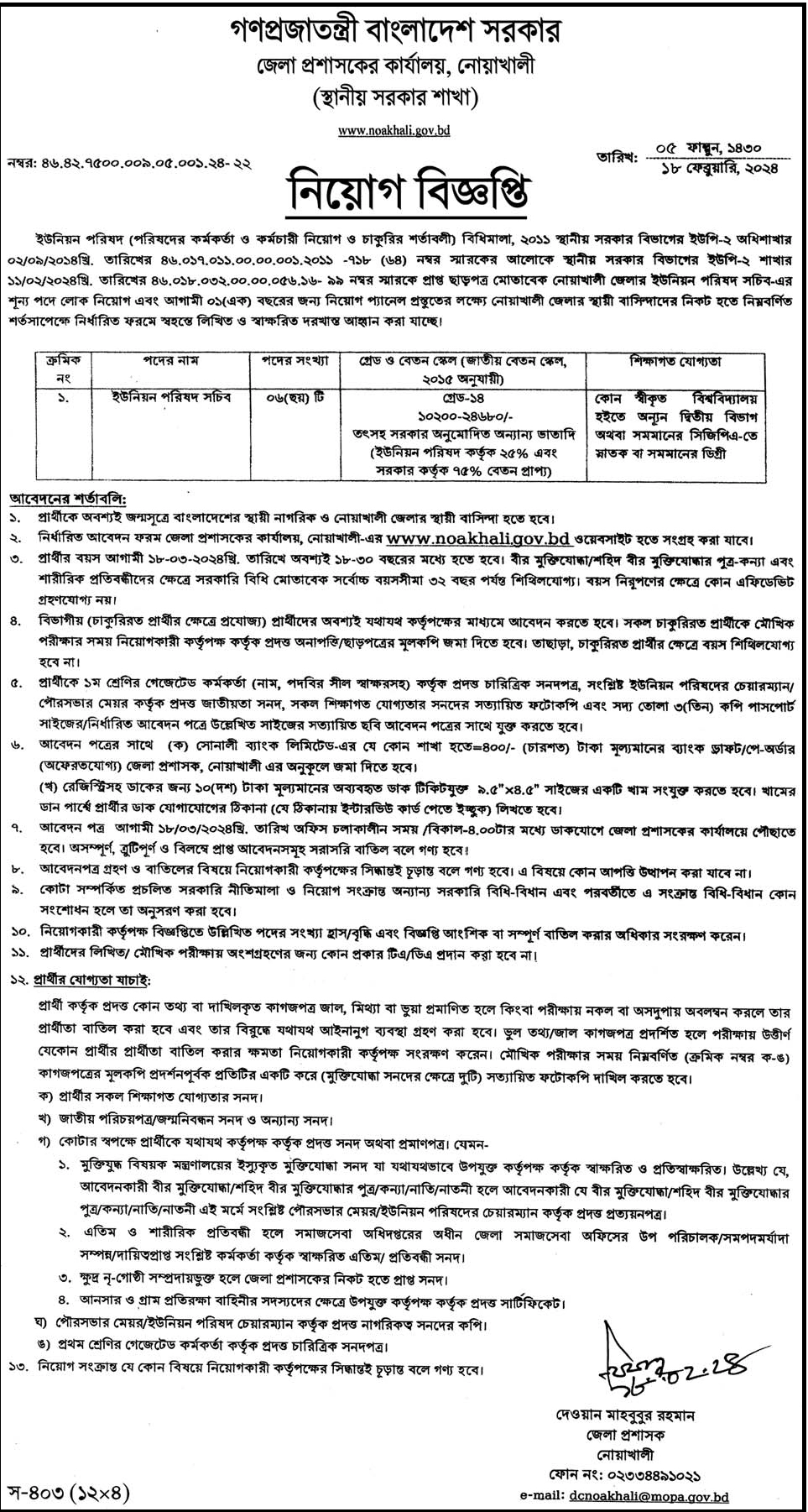

Download Circular Apply Online

AIA Group Limited, Asia’s largest insurance company, and Tata Sons Private Limited, one of the world’s largest business groups, have formed a joint venture to form Tata AIA Life Insurance Company. The assets under management for Tata AIA Life Insurance Company in 2021 will be INR 46,281 crores. In addition to the many insurance solutions it offers, Tata AIA Life provides wealth management services and protection. Customers receive excellent service and straightforward, practical solutions for their unique insurance needs.

EN Explore Info English Version of Explore Info

EN Explore Info English Version of Explore Info